A resilient business model and strategic capital allocation helps us to grow our business sustainably and define our way forward. Stringent cost efficiency measures have aided us to stay on track and create value sustainably, while delivering consistent growth.

Through effective cost optimisation measures and healthy cashflow generation, we have been able to strengthen our balance sheet significantly.

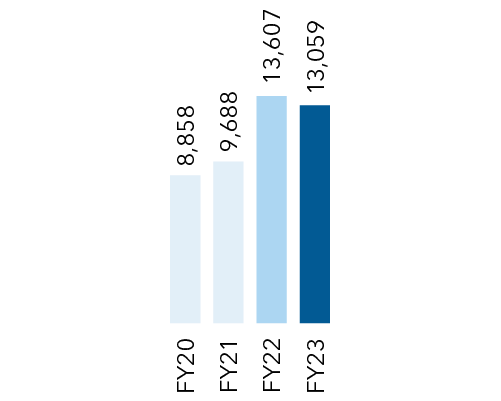

Revenue (H in Crore)

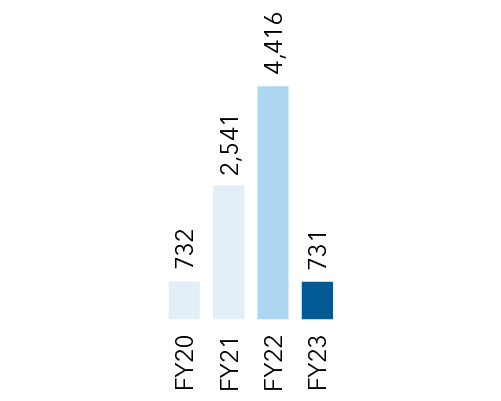

EBITDA (H in Crore)

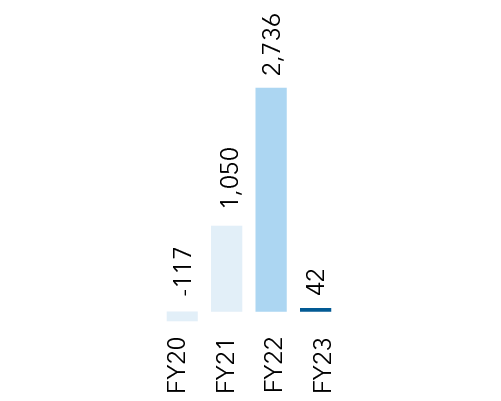

PAT (H in Crore)

(₹ in crore)

(₹ EBITDA)

(₹ in crore)

During FY 2023, we have maintained a robust balance sheet through our timely repayment of debts, sharper focus on eliminating supply disruptions, proper inventory management and effective cash flow management. We have taken initiatives to reduce our financial risks to maintain our bottom line and create greater value for our stakeholders.

Our focused efforts have led to positive growth, especially in our domestic revenue mix, which has witnessed a domestic market share of 23% in FY 2023 as compared to 2% of the previous fiscal year. The revenue of our value-added product mix has improved at a moderate level, followed by significant revenue growth in our Wire Rods and Primary Foundry Alloy product ranges.

To maintain a healthy financial condition and grapple with the headwinds of decreasing aluminium price and increasing cost of production, we have significantly implemented a strong governance over the working capital management through robust technology such as automated invoicing and payment system which streamlines the monitoring system and helps reduce risks. We also conduct regular audits for optimising our working capital in terms of identifying the areas for improvement and ensure compliance with policies and procedures.

Thorough implementation of all policies and regulations has enabled us to recover our losses incurred due to the volatility in the aluminium and raw material prices and gain a strong profit margin in the second half of FY2023.

We have implemented a policy to make transactions with the debtors against Letter of Credit (LC) which guarantees complete security.

The debt-equity ratio has been improved through efficient cash flow and inventory management, and the regular transactions with the supply chain partners and customers. Maintaining a healthy profit margin has not only helped us to clear the outstanding debts but also enabled us towards investing in new projects with relying on additional debt financing.

We also have a robust inventory management system in place. We classified inventories based on the nature of their movement. The fastmoving inventories are maintained in high quantities to avoid stockouts and slow-moving inventories are ordered according to the requirement to reduce over-stocking.

As a responsible company, we strictly control the reorder point of products depending on demand and lead time. In addition, we have obtained better pricing and bulk discounts for raw materials due to our long and loyal relationships with our supplier partners. This has resulted in a positive way over the production cost.

At BALCO, we strive to maintain a strong cash flow which provides us with sufficient funds to execute future growth plans. We have also strengthened our credit rating, which allows us to obtain debt funding at a affordable interest rate, enabling us to improve our financial performance and maintain an optimum capital structure.

We are striving to mitigate our financial risks as a result of interest and exchange rate volatility, higher commodity costs, and decreased demand. Multiple task force has been formed within the organisation to address separate issues and come up with possible solutions along with curtailing the overall expenses of the Company.

We are investing towards adopting automation and digitalisation techniques in our operations across various departments which will enhance the fulfilment of our sustainability goals. Moreover, to ensure a holistic development of our organisation we have emphasised on various new segments and verticals to serve a greater group of customers which will eventually improve the bottom line.

As a part of our short-term goal, our objective is to address the niche markets along with different valueadded products under our existing product portfolio which will ensure on-boarding of new customers, complete capacity utilisation and enhanced profit margin. We have plans to enter in the new age product segments of rolling sheets and aluminium composite panels which will ensure higher traction and new market penetration.

Government initiatives such as the ‘Make in India’ and the PLI schemes are increasing productive volumes. The Government is also rolling out initiatives to upgrade electrcical conductors and boost the production of solar panels. These initiatives will promote the use of Green Aluminium in India and enhance our profitability.